Digital Gold Mining: Assessing the Return on Investment of Your Crypto Equipment

In the ever-evolving landscape of cryptocurrencies, digital gold mining has become an intriguing avenue for investors seeking to capitalize on the burgeoning market. At the core of this endeavor lies the critical decision-making process focused on assessing the return on investment (ROI) of crypto equipment. Whether you’re investing in powerful Bitcoin (BTC) mining rigs or diversifying into Ethereum (ETH) and Dogecoin (DOG) mining machines, understanding the delicate balance between hardware costs, electricity consumption, and network difficulty can define the profitability of your mining venture.

Bitcoin remains the flagship cryptocurrency, often dubbed “digital gold” due to its capped supply and storied reputation. The mining process for BTC demands high-performance ASIC (Application-Specific Integrated Circuit) miners, tailored to handle the SHA-256 algorithm with optimal efficiency. However, the obstacle lies not merely in acquiring mining rigs but in the intricate dance of operational expenses, such as cooling, electricity rates, and hosting fees—particularly if you choose to outsource your mining setup to a reliable mining farm or hosting service. This is where companies specializing in mining machine hosting shine, offering a blend of hardware management, uptime assurance, and sometimes even maintenance, thereby alleviating the physical burden for miners.

Meanwhile, Ethereum mining, based on the Ethash algorithm, has traditionally depended on GPU mining rigs, which also unlock opportunities for everyday miners who might not afford costly ASICs. With the transition to Ethereum 2.0 and the gradual shift to Proof of Stake (PoS), miners find themselves reassessing the lifecycle and profitability horizon of their ETH mining operations. Alternative currencies like Dogecoin, initially a meme-driven token, have surprisingly gained traction within the mining community due to merged mining or its affiliation with Litecoin’s Scrypt algorithm, presenting a nuanced layer of choices for miners eyeing ROI maximization.

Mining farms form the backbone of large-scale mining operations, often situated in regions with favorable electricity costs and climate conditions—think Iceland’s natural cooling or the U.S. Pacific Northwest’s inexpensive hydroelectric power. These farms consolidate hundreds or thousands of miners, orchestrated meticulously to optimize hash rate output. For smaller players, hosting services enable participation without the upfront capital expenditures or technical know-how, democratizing access to mining’s lucrative potential. Yet, investors must weigh the hosting fees against the gain in daily payouts, considering also the volatility inherent in cryptocurrency markets.

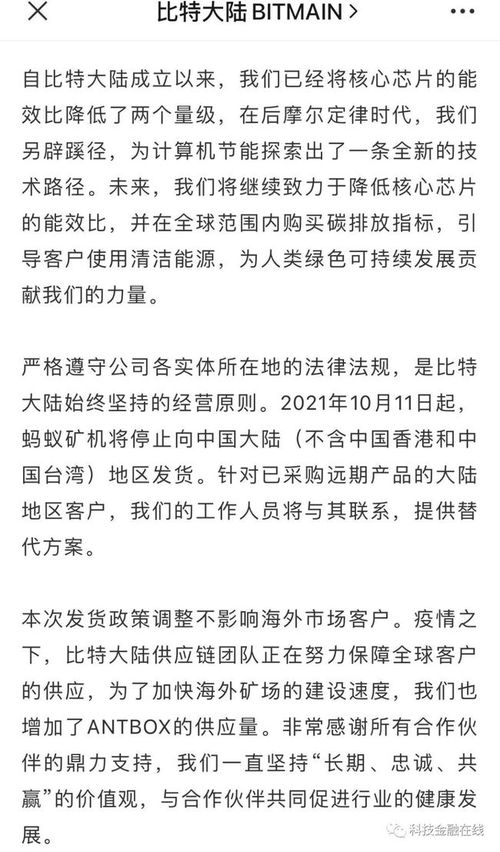

To truly gauge ROI, miners must perform a granular analysis incorporating several variables: the initial price of their mining rig, anticipated hash rate, electricity consumption measured in kilowatt-hours, cooling overhead, pool fees, and the coin’s market price fluctuations. Tools and calculators abound online, presenting prospective miners with projections that reveal whether the reward justifies the investment. Additionally, emerging metrics like energy efficiency (joules per terahash for Bitcoin miners) influence buying decisions, propelling continuous innovation within mining rig manufacturing. Companies driving these advancements emphasize sustainability—an increasingly critical factor as regulatory and environmental scrutiny of crypto mining intensifies globally.

Beyond the technical and financial aspects, cryptocurrency exchanges play an indispensable role in translating mined coins into liquid assets. After mining, a miner’s choice of exchange can affect profitability through transaction fees, withdrawal limits, and ease of converting assets to fiat or other cryptocurrencies. Some miners opt for decentralized exchanges (DEXs), betting on privacy, security, and potential liquidity incentives, while others prefer centralized platforms for their speed and user-friendly interfaces. Moreover, smart miners strategically time their coin sales to capitalize on favorable market trends, adding another layer of complexity to ROI calculations.

In this dynamic ecosystem, remaining adaptable is vital. The rapidly shifting difficulty levels, emergent altcoins, and evolving blockchain protocols challenge miners to stay vigilant. Staying updated on firmware upgrades, firmware optimization for mining rigs, or joining collaborative mining pools can extend equipment lifespan and boost efficient coin production. Furthermore, the continuous innovation by manufacturers of mining machines ensures that newer models periodically supplant older ones, nudging miners to evaluate when to upgrade or expand their hardware portfolio to sustain competitive advantage.

Mining is no longer just a technical experiment but a multifaceted business where strategic decision-making influences profitability. From Bitcoin ASICs to Ethereum and Dogecoin mining possibilities, understanding the nuances of hardware capabilities, operational costs, and market trends equips miners to interpret the true ROI of their equipment. Companies that sell and host mining machines serve as crucial partners in this journey, offering the infrastructure and expertise to demystify complexities and optimize returns.

One Response

A surprisingly nuanced look at crypto mining ROI. Beyond just hash rate, factors like energy costs, hardware depreciation, and even temperature fluctuations are explored. Essential reading for aspiring digital gold miners.